Smith’s Invisible Hand; Its Salience & Fault Lines

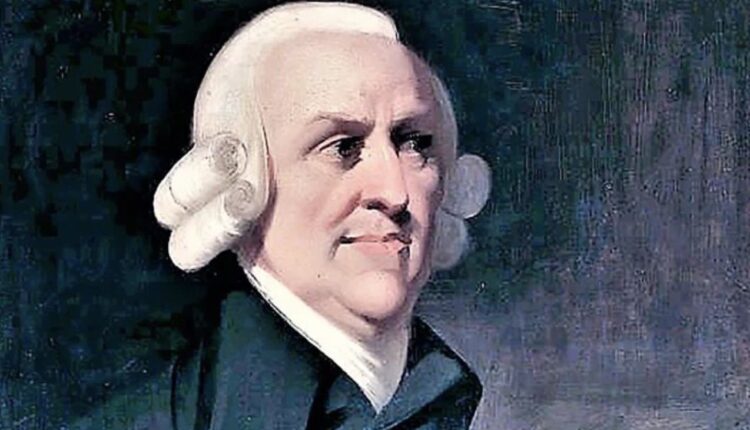

This June marks the 300th birth anniversary of Adam Smith, the Scottish philosopher, considered to

be the father of modern economic thinking. Smith witnessed the beginning of the Industrial

Revolution which fundamentally changed the Western World. During this time and the decades that

followed Britain became World’s first industrial economy. This extraordinary period formed the

backdrop for one of the most influential books in economics The Wealth of Nations (1776), which he

took a decade to write. It sets out the concept of the ‘invisible hand ‘which refers to the unforeseen

market forces that set prices by equating supply and demand. He was concerned about distortions

that could cause the market prices to deviate too far from the national price. Both the state and

business could distort prices by interfering with market forces, the former by taxation and the latter

by keeping prices artificially high. He wrote: ‘Upon the whole, it is by far the best government policy

to leave things to their natural course.’ He also hoisted the concept of self-interest as the kernel of

the free market which ‘allows producers and consumers to produce & consume efficiently ‘. He

wrote:’ It is not from the benevolence of the butcher, the brewer, or the baker that we expect our

dinner, but from their regard to their own self-interest.’

In 1759 he wrote The Theory of Moral Sentiments, which made him a well-known figure in the

European Enlightenment along with David Hume. Markets, for him, can function well when there is

free speech, free expression, debate, and dissent. Smith wanted societies to evolve towards more

freedom in an organic consensual way. His book on Moral Sentiments was aimed to influence British

MPs to support a peaceful resolution to the American colonies’ War of Independence. Its serendipity

that America’s independence coincided with the publication of Wealth of Nations the same year. No

wonder his idea of a free market & free speech has the best resonance in America. Ironically USA

also took over the mantle of global hegemon ( Pax Americana) by 1940 from the UK ( Pax Britannica)

& the dollar trumped the pound sterling as the dominant global currency. Alan Greenspan, the

legendary Fed Governor writes in his autobiography ‘The Age of Turbulence’ (2007) ‘one of the

greatest achievements in human intellectual history created the modern vision of people free to

choose to act according to their individual self-interest’.

It was Smith who wrote: The private pursuit of self-interest would lead, as if by an invisible hand, to

the wellbeing of all. When the US economy hit the financial crisis in 2007, the triumphal march of

the free market as an omnipotent idea & the invisible hand promoting the well-being of all met its

most serious challenge. The Stiglitz Report (2009) and in his subsequent book ‘Price of Inequality’

(2012) Stiglitz writes that in the aftermath of the financial crisis, no one today would argue that the

bankers’ self-interest would lead to the well-being of all. When the market works well, it is because

private returns and social benefits are well aligned. Markets by themselves often fail to produce

efficient & desirable outcomes. And there is a role for the government in correcting these market

failures, that is designing taxes and regulations that bring private incentives and social returns into

alignment. Deregulation in the 90s was also a major factor when led to the banking collapse as

Clinton repealed the Glass Steagall Act (1933) which separated the banking function from the

investment function and brought in the Gramm Leach Bliely Act in 1999. The finance sector used its

political muscle to make sure that the market failure was not corrected.

India embraced the free market philosophy of Smith in 1991, by making a U-turn of its economic

ideology of socialism from 1950-1990. The impact of the free market philosophy in determining

prices, interest & deposit rates, foreign exchange rates, lowering of trade barriers, lowering taxes,

and encouraging FDI & FII inflow has doubled the savings rate, doubled GDP growth, significant

increase export, and imports & FDI & FII inflow. On the other hand, wanton privatization of education

& health services has deprived a large number of people to avail of their services because of

unaffordable costs. Similarly scant attention is being paid to improving the nutrition level of children

and adolescent girls, leading to high levels of stunting & anemia. Adam Smith’s quest for wealth

maximization through the free market & invisible hands remains an unfinished & troubled script for

India’s bottom half. In particular, Smith would be troubled by the pathetic learning outcomes in

government schools. The Scottish scholar put a premium on government spending on education and

advocated for universal education.

Smith quite clearly overlooked the distributional aspects of wealth creation. The concept of social

justice and economic equity was brought to the center stage by Karl Marx, who wrote Das Capital

(1867), ninety years after Smith’s magnum opus. For Marx, Capitalism contains the seeds of its own

destruction & will usher in a classless society through revolution. Though the Russian Revolution

happened in 1917 it capsized on its own weight, due to a lack of freedom, choice, incentives &

market signals. Similarly, the global financial crisis of 2007-2008 has unveiled the perils of lax

regulation, free capital mobility without regulation, the proliferation of toxic financial products, and

excessive greed. As Jeffrey Sachs, the poster boy of the Millenium Development Goals writes: Our

greatest illusion is that a healthy society can be built around mindless pursuit of wealth. He could not

have been more prescient, when the US financial crisis struck, and the invisible hand of the free

market made a few unscrupulous bankers, speculators, and regulators have a bonanza at the

expense of a large number of small investors, depositors & common men.

Sadly, free market apostles like Jagdish Bhagawati, believe that the US Financial crisis is transient and

that free markets will fix themselves. This was precisely the pitfall in the theory of classical

economists that automatic equilibrium will be established during the economic depression of the

1930s, which prompted Keynes to observe in his magnum opus ‘General Theory of Income’(1936)

that market equilibrium is not automatic & government intervention is required for creating public

employment in order to lift the economy out of the quagmire of depression. History is witness to the

New Deal program of FDR, the American President, and how the US economy by 1940 had full

employment and a 40% share of global GDP. That sowed the seeds of the welfare state during the

economic crisis. Smith germinated the idea of a free market economy & wealth creation, Marx wrote

about the need for equity & social justice, while Keynes planted the seedling of a welfare state in a

capitalist country like the USA. Smith fired the first intellectual salvo in economic understanding; his

delectable cocktail of the free market, invisible hand & self-interest. His invisible hand concept will

be salient, with its warts & moles.